The last thing you want to do is worry about budget. Whether managing a team, planning a project, or just organizing an offsite, you’ve got enough to think about. The best way to put your mind to rest is simply through accurate, easily visible budget management, but in practice, that can be surprisingly hard to do.

Spreadsheets are great for storing information—but terrible for visualizing it (and even worse for collaborating). Existing software has extensive features you may not need, and these tools are often out of reach for a small business or team. When all you need is a simple interface, you don’t want to have to pay for features that just make your work more complicated.

Luckily, there is a better way. With a no code platform like Glide, you can turn your existing spreadsheets into intuitive apps to track your budget. You can customize them to display the metrics that are important to you and create workflows for you and your team to submit information and understand where you stand with your budget goals. Your software fits your workflow instead of the other way around.

Building a custom budget dashboard app that aligns precisely with the workflows you need and the metrics you want to monitor is the best way to manage your money and your team.

What is a custom budget dashboard?

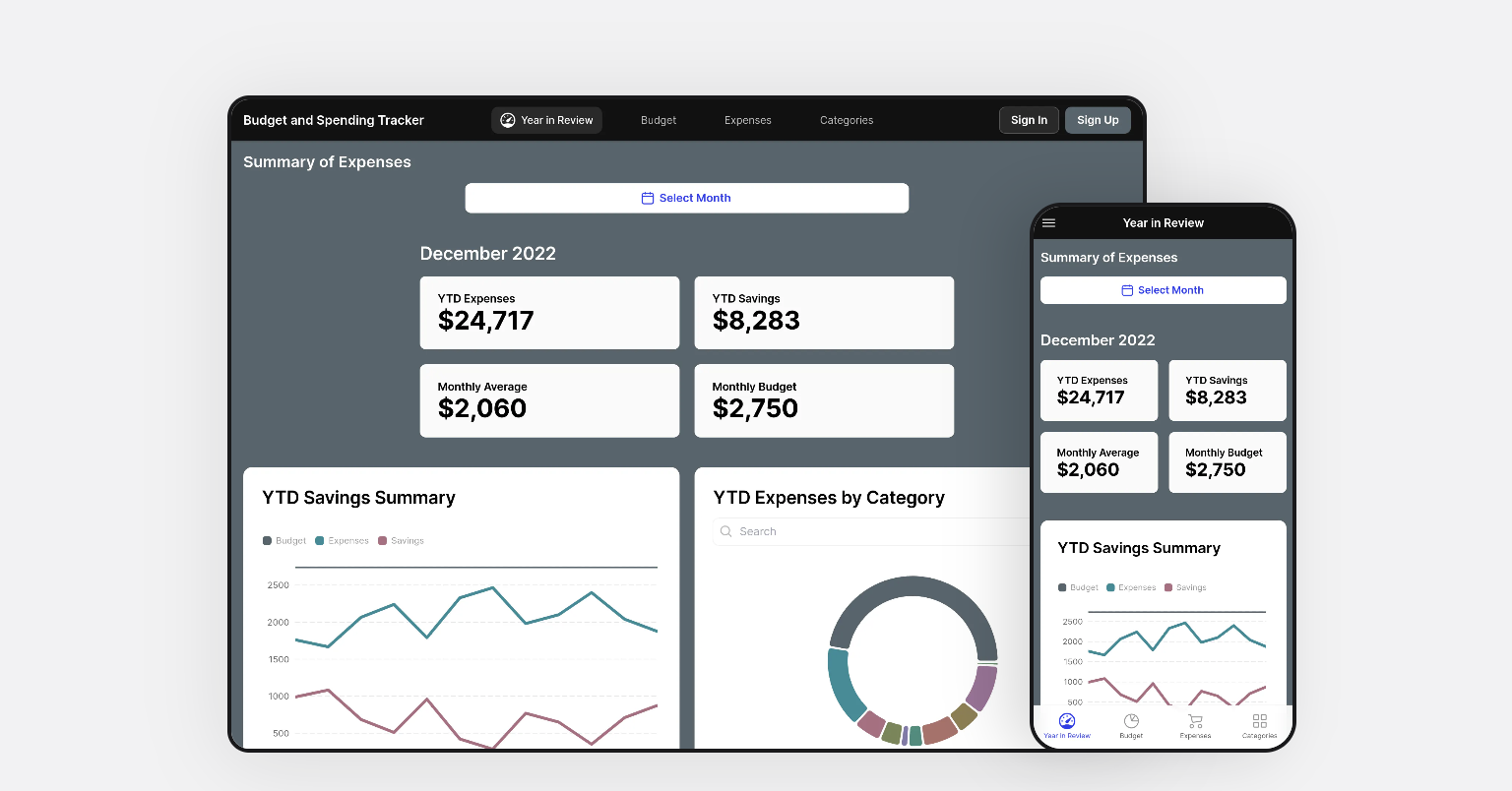

A budget dashboard is a visual representation of your financial data. It allows you to track and monitor your budget and spending so you can make better financial plans and fully informed business decisions.

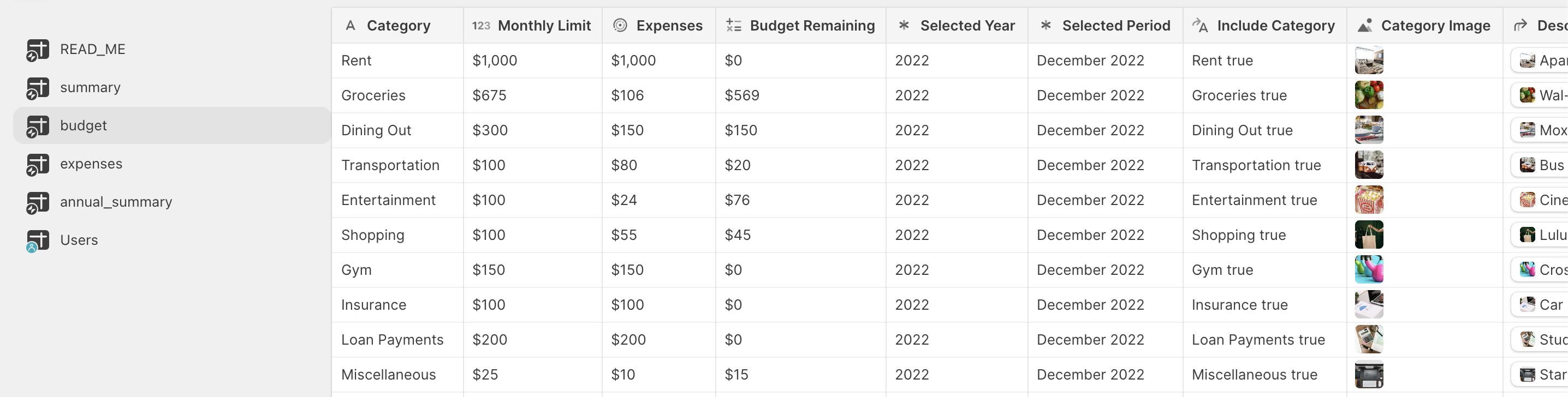

Building a custom dashboard with no code lets you control your interface, which metrics you want to track, and which workflows you want to perform with your app. You can still store your data in a spreadsheet or database, but you get a much more user-friendly interface to better visualize your budget and financial information.

If needed, you can create multiple budget dashboards for different purposes. You can create departmental dashboards, like a marketing team dashboard, monthly budget tracker, or project-specific ones, such as a new product release budget dashboard. Most importantly, the goal is to see how your finances change over time, whether you’re in line with or exceeding your budget goals, and adjust accordingly.

What you can do with your custom dashboard

Build features into your dashboard that can help you manage your finances more effectively and reduce the labor involved in keeping track of expenses. Your dashboard app can help you with:

Budget planning: Interactive, easy-to-read graphs and charts help with budget planning. You can easily visualize budgets with bar charts or line graphs to see how your financials change over time.

Budget tracking: Pull data from different tools and data sources into a centralized platform where you can see if you’re hitting financial KPIs like “budget vs. total expenses.” Track and compare your budgeted expenses against actual expenses right in your dashboard.

Communicating financial information: An internal app is a great way to communicate financial information with leadership or within a team. It lets you display a big-picture view of your budget without having to share detailed (and potentially sensitive) spreadsheet data.

A Survey Monkey Poll indicates that 32% of workers often think, "This meeting could have been an email." Instead of holding unnecessary meetings to review budget details, simply share a link to the app so everyone can access the information at their convenience.

Resource allocation: Share data and workflows with the other business apps you build. Connect your employee salary information or lunch expenses from your employee portal directly to your “expenses” tab or import sales from your inventory management app to your “income” tab.

Providing real-time insights: Instead of waiting until the end of the month to know what’s happening, get real-time, live data that you can access anytime.

Why build a custom budget dashboard app?

While it used to take development skills to create a tool like this, Glide enables you to build your own dashboard from scratch or from a template without having to code anything yourself.

Your custom app will be:

Customizable: You need to be able to customize your dashboard’s interface to your preference, tracking what metrics are important to your specific financial situation and adding custom features or workflows to your dashboard.

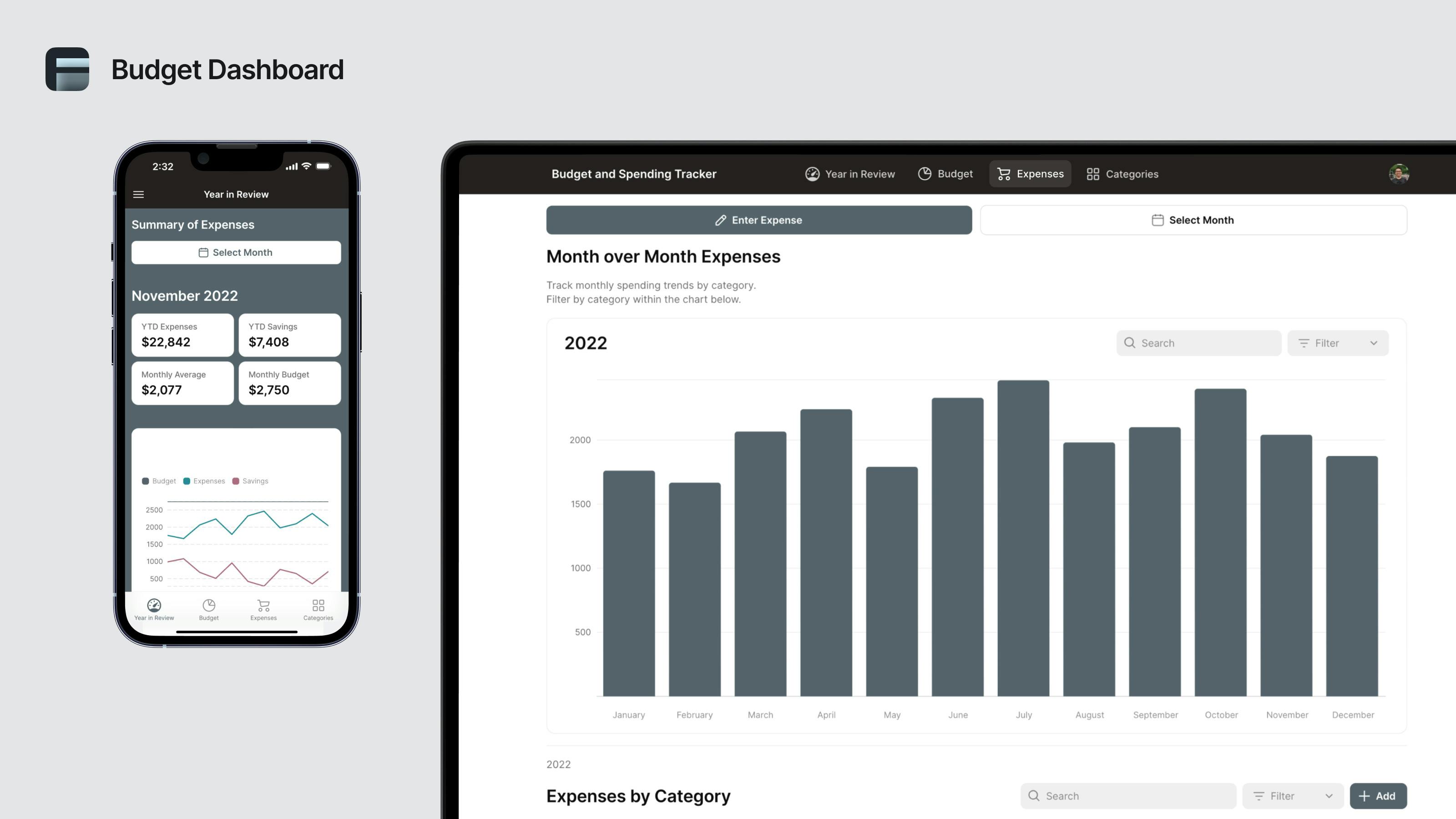

Easy to use on mobile: You can stay on top of your budget more easily if you have easy access to your financial data wherever you are. Your dashboard should adapt to be viewed on a tablet or smartphone just as easily as if you were at your computer. Most budget spreadsheets have limited mobile functionality. Your app gives them a much more practical interface.

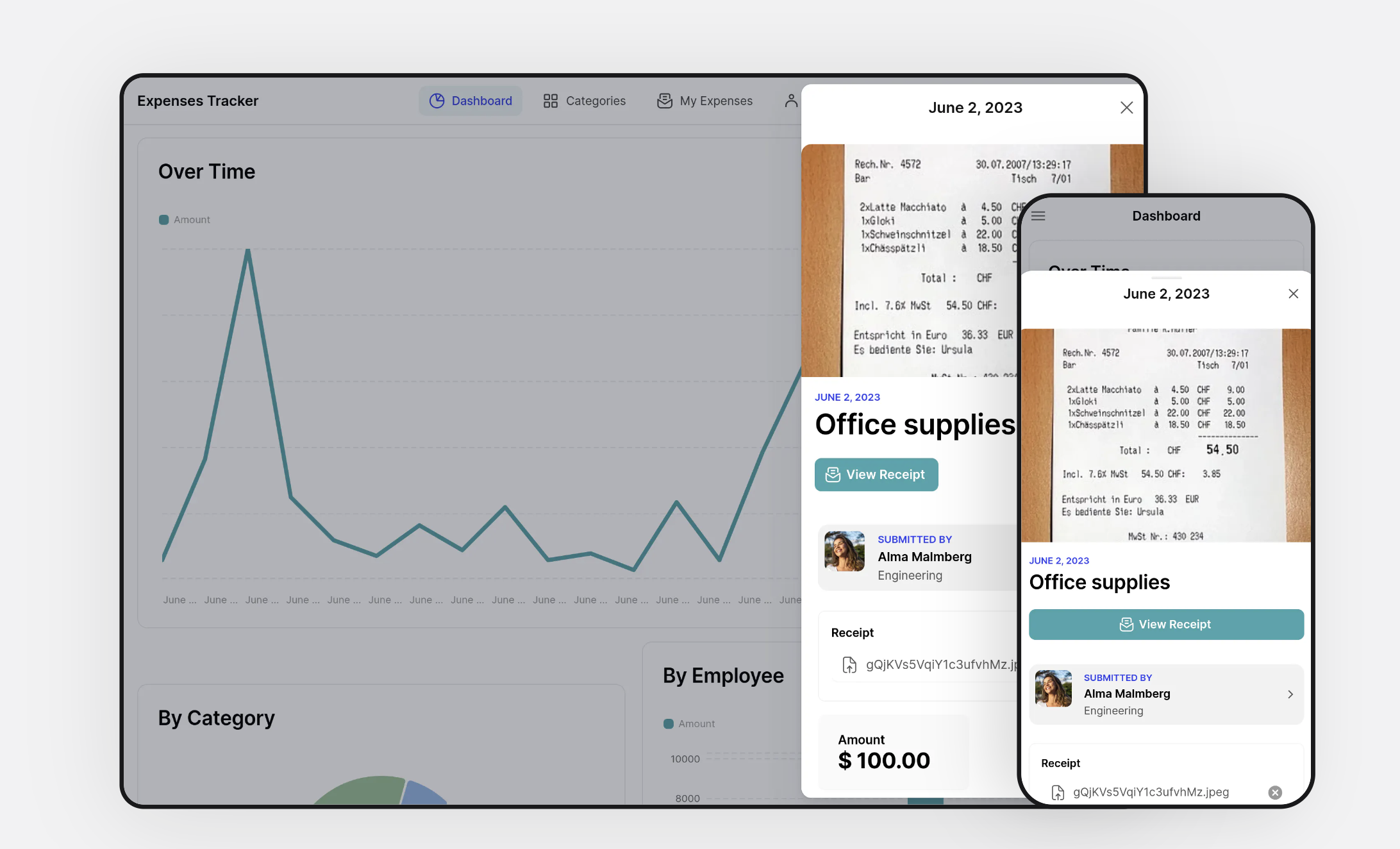

Expenses are also often incurred while on site, traveling, or away from a desk in general. Having a mobile app you can use to quickly snap photos of receipts or record important notes helps ensure your financial records are fully accurate and up to date.

Integrated with your other software: Build integrations with all the software you use to track, pay, or receive money, such as Stripe and Salesforce. This lets you sync your information and import data automatically. Connect with other custom apps you’ve built in Glide as well, such as a CRM or inventory management app, to unify all the data you use for your business.

How to build a custom budget dashboard in Glide

Glide is an intuitive drag-and-drop platform that helps you build business apps without writing code. You can start from an expense tracker or budget template or follow detailed tutorials that will help you build your interface, connect data, and refine your app.

Start a free trial to begin building an app from scratch.

Prepare and connect your data

If you have existing financial datasets in a spreadsheet or database such as Google Sheets, Airtable, Microsoft Excel, or SQL databases, you can connect that data source directly to your new app. You can also use native Glide Tables to store your data.

Once your data sources are connected, your Glide app will reflect all your inputted data in real time. It will automatically update if you make any changes.

Customize your layout

Once your data is uploaded, customize your layout. Add screens to your dashboard based on what tasks and views are important to you. If you’ve got a campaign or event you’re tracking data for, make a screen for each one. For time-based tasks, add a calendar view. Add a monthly budget, year-to-date figures, or whatever other metrics you need.

Add visualizations

Add charts and graphs to visualize your data in the way that works best for you. You can even present multiple charts side-by-side using a Container Component. Label your y-labels and x-labels and select the data you wish to display in each chart.

Add interactivity and functionality

Add actions and workflows to your app to make your app more useful.

Set alerts and notifications

Add push notifications or alerts to keep you informed of important activity in your dashboard. Create specific triggers and flows according to what’s essential to your business spending and send notifications and alerts straight to your mobile device.

Add forms for user submissions

If you want to track spending by employee, you can add a team view with individual profiles. Then, add a form for employees to upload items such as invoices and receipts, add notes with a form field, or assign categories to the items with a drop-down menu.

Automatically upload financial data with AI

Use AI to automatically extract expenses and other data from paper sources. Glide’s AI image-to-text feature lets users snap photos of invoices or receipts and automatically extract text from that image. AI will extract financial figures, taxes, names of vendors, and more. It will even automatically assign the expense to the correct category.

You can also extract the info as JSON data. Extract the date from the receipt, and Glide AI will attach the expense to the corresponding date, which you can see in your ‘Calendar View.’

Set permissions

Assign user-profiles and set roles and permissions for your users. Depending on how they need to interact with your data, you can assign team members as editors, admins, or users. Some members have restricted views, while others can see all of your data. Some roles can edit any data, while others can only submit data or view it.

Publish and share your app

When you’re done creating your dashboard, publish and share your app with your team via a link or QR code. Add your dashboard app to your knowledge management system under “Tools and Technology” so your colleagues can easily access your app.

Expand your business’s toolkit with Glide

Building your own software puts you in full control of the tools you use at work. Your new budget dashboard can be connected via workflows or data to all the other tools you use to get your work done. Create a project management tool, a customer portal, or a knowledge management system without having to hire expensive developers or adapt to clunky pre-built software.

Templates and tutorials make it easy to get started, and Glide Experts are available when you just need to get up and running fast.

Manage your real estate finances with custom software

See how

Megan is a multilingual writer, and B2B marketing professional dedicated to bridging product, content, and communications. Based between Lagos and London, she loves developing and sharing her skill with SQL, no code, and UX design.