“Glide allowed me, someone with no coding background, to bring an advanced investment risk management app to life. With the expertise of Art from V88, we avoided the massive costs and delays of traditional development—saving hundreds of thousands of dollars and launching months early. The speed, flexibility, and quality we achieved with Glide proved that no-code can deliver enterprise-grade results.”

The financial education Patrick Ceresna provides through Big Picture Trading can be game-changing for his clients. Their focus is on options trading through the Cashflow Compounder program, where they help clients manage risk intelligently. Their membership was growing fast, and they needed a risk management tool to help their members understand their investments and give them real-time visibility into their risks. However, their industry is so niche that the tool they needed simply didn’t exist yet.

“You'll always hear that options are risky. They’re a leverage tool. You can make outsized gains or you can lose everything if you don't know how to use it,” explained Massil Beguenane, their Investment & Client Success Lead. “Right now, the bigger problem is that there are no tools out there that show you the live risk that you're currently taking on, how much money you stand to lose at any one point, et cetera.”

“Even the biggest brokers like Charles Schwab, Interactive Brokers, or Fidelity don’t have specialized tools for options trading. Since nothing was out there in the market, we're like, okay, let's go and build it ourselves.”

Their risk management app helps members save hundreds of thousands in avoided investing mistakes

“Before our Glide app, becoming a consistently profitable option seller often took years of market experience and expensive lessons,” said Patrick Ceresna, founder of Big Picture Trading. “Now, in as little as a few months, our members are applying professional-grade risk management that saves them six figures in avoidable losses while learning the process. It’s not just about speed, it’s about building disciplined, confident traders who can execute with the precision of professional money managers.”

“The app is part of our product,” explained Massil. “A lot of people learn trading through losing money, unfortunately. The app helps them sidestep a lot of that.” Their risk management tool offers people more confidence in their training. “It’s increased the learning curve. Typically, it took members a year to learn the process. Using the tool, we brought it down to six months or less. Now we're really looking at growing and doubling or tripling our membership in the next year through the tool.”

“It definitely increased trust in our services, our professionalism, and our product. The fact that we have this professional-grade tool makes us real.”

Being in education in the finance space comes with increased skepticism. “There are so many scams, so many people saying come learn this one thing and you'll become rich. We don't do that in the first place. Instead, we have a real tool that shows them the process and how they can do it themselves.”

Excel spreadsheets were messy and couldn't keep up with real-time needs

Before building their Glide app, the first solution Massil put together was based on Excel spreadsheets. “I called it my Frankenstein,” said Massil. “You can imagine Excel is so messy to use. I overloaded the spreadsheet so it would have all the features we wanted, but then it would take way too long for anything to load. And it's Excel, so if it breaks, you have to resend the sheet to everybody, and whatever they've already done is now useless.”

“I'm halfway through the deliverable date, and I'm like, oh my God, like what did I do? I can't present this.”

Creating an effective MVP of the tool

“We just needed a minimum viable product that we know works, so we can get real-time feedback through customers with something that's cost-effective and easy to build,” said Massil.

To do this, Big Picture Trading brought a consultant on board to help him figure out how to build an MVP. Pete Veal had experience building internal software for big financial companies like Barclays in London, which managed millions of transactions. He was the one who introduced their team to Glide.

“I told him we could hire a developer to build us a tool since no one on the team is really tech savvy. And he was like, no, the last thing you want to do is hire a dev to build a tool like this,” said Massil. “Pete looked at different no code platforms, and then he was like, Massil, I have to show you something. This guy–on Glide—had built my whole spreadsheet into an app.

“We were going to hire a dev, and it was going to take six to nine months to build. Instead, we had an MVP done in a couple of weeks.”

“Pete always talks about risk, and how managing risk is the most important thing, which, funny enough, is also the most important thing when investing,” said Massil. “Glide can provide us with this very low-risk solution since we build on very tight guardrails.”

Building a simple, beautiful risk management tool with Glide

It was clear that Glide was the right solution for the business. Massil enlisted the help of V88, a leading Glide agency, to get the app polished and launched in a short timeframe. “They gave us an incredible dev. We put Art on the team, and we pretty much hit the ground running.”

At that point, the build went quickly, and by September, they had launched the first version of the risk management tool to their membership. “Since then it's been amazing,” he said.

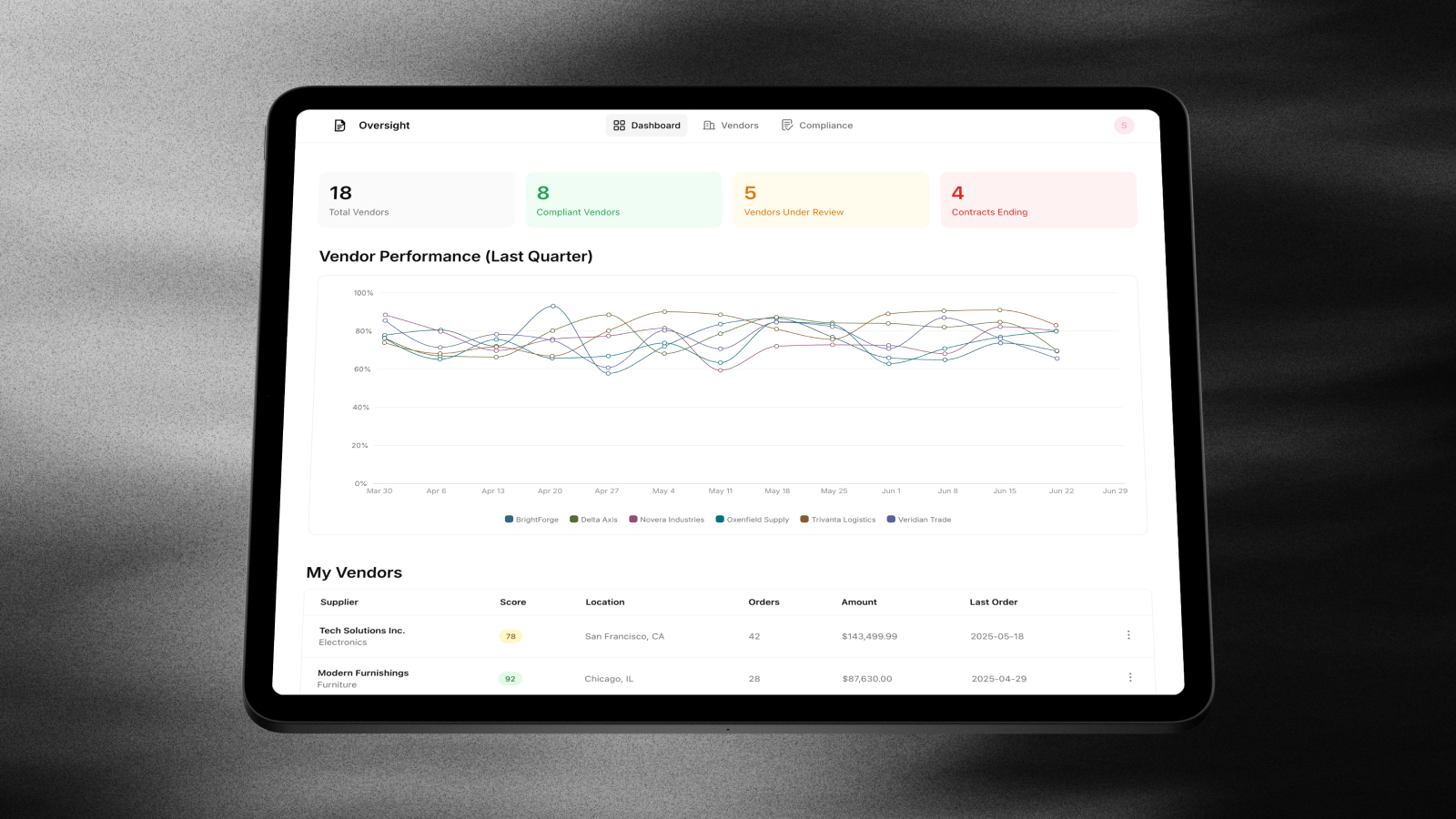

The goal was to create a simple risk management tool that had four big metrics. “If you just follow those four big numbers, you'll know what's going on in your portfolio at all times,” explained Massil. “We also needed to make it look good to you so people would actually want to use it.” With Glide, they created a beautiful dashboard with four big numbers, a few other data points, and a place for members to input trades in real time.

“People really loved it. They love the simplicity of it.”